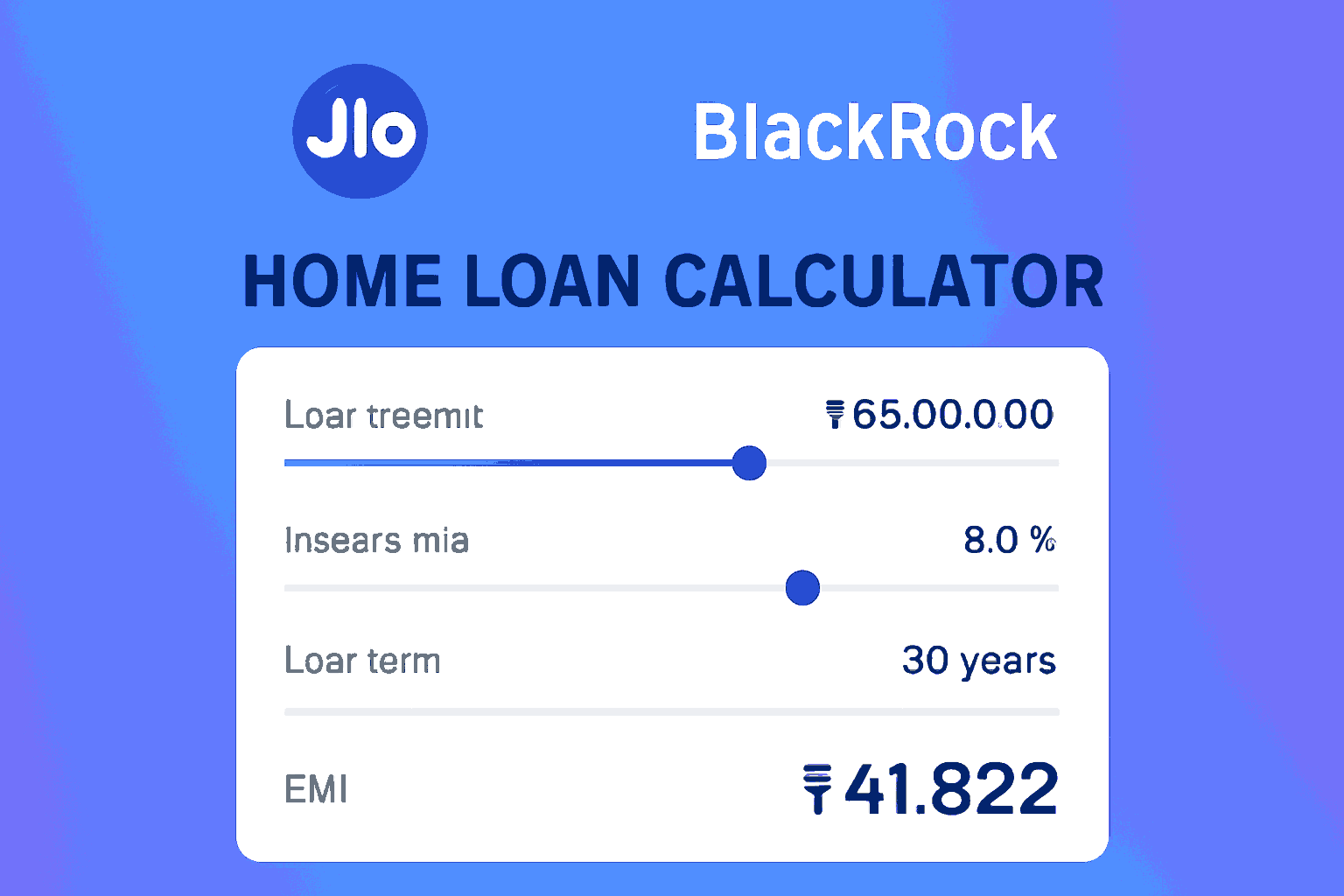

Home Loan EMI Calculator

Calculate your monthly payments and plan your home loan effectively

Loan Details

Calculation Results

| Year | Principal (₹) | Interest (₹) | Balance (₹) |

|---|

About Home Loan EMI

Buying a home is one of the most significant financial decisions you’ll make. Our Jio Home Loan EMI Calculator helps you make informed decisions by providing accurate monthly payment estimates based on your loan amount, interest rate, and tenure.

How to Use Our Home Loan EMI Calculator

Simply adjust the sliders for loan amount, interest rate, and loan tenure to see instant results. Our calculator will show you:

- Your estimated monthly EMI payment

- Total interest payable over the loan term

- Principal vs. interest breakdown

- Amortization schedule showing yearly payments

Benefits of Using Our EMI Calculator

Accurate Calculations

Get precise EMI estimates using the standard home loan calculation formula.

Financial Planning

Plan your budget effectively by knowing your monthly obligations in advance.

Compare Options

Test different loan scenarios to find the most suitable option for your needs.

Amortization Schedule

Understand how each payment is split between principal and interest over time.

About The Creator

Pradeep Chauhan

Financial Tools Developer & Investment Specialist

With over 12 years of experience in financial technology and investment planning, I create powerful tools that simplify complex financial calculations. My mission is to empower individuals with accurate, easy-to-use calculators to make informed financial decisions.

I’ve developed numerous financial tools used by thousands of people to plan their investments, loans, and savings. My expertise lies in creating intuitive interfaces that transform complicated financial data into actionable insights.

As a certified financial planner and technology enthusiast, I bridge the gap between complex financial concepts and everyday users, helping people make better financial decisions for their future.

Frequently Asked Questions

- Loan Amount: Higher loan amounts result in higher EMIs

- Interest Rate: Higher rates increase your EMI

- Loan Tenure: Longer tenures reduce EMI but increase total interest paid

This depends on your financial situation:

- Shorter tenure: Higher EMIs but less total interest paid

- Longer tenure: Lower EMIs but more total interest paid

Use our calculator to compare different tenures and find the right balance between affordable EMIs and reasonable interest costs.